CONCENTRATED GLOBAL EQUITY

Long Equity Investment Stategy

Long Equity runs a single concentrated investment strategy consisting of value-creating and price-setting global companies. We only hold companies that can: (i) invest their capital at significantly higher returns than their cost of capital (value creation); and (ii) raise their prices without impacting demand (price setting). Their returns on capital must be high, consistent and unleveraged, with competitive advantages, ideally switching costs and network effects, preventing high returns from being competed away. We pursue a long-term strategy that aims to minimise transaction costs and defer capital gains by only investing in companies capable of compounding value indefinitely.

Performance

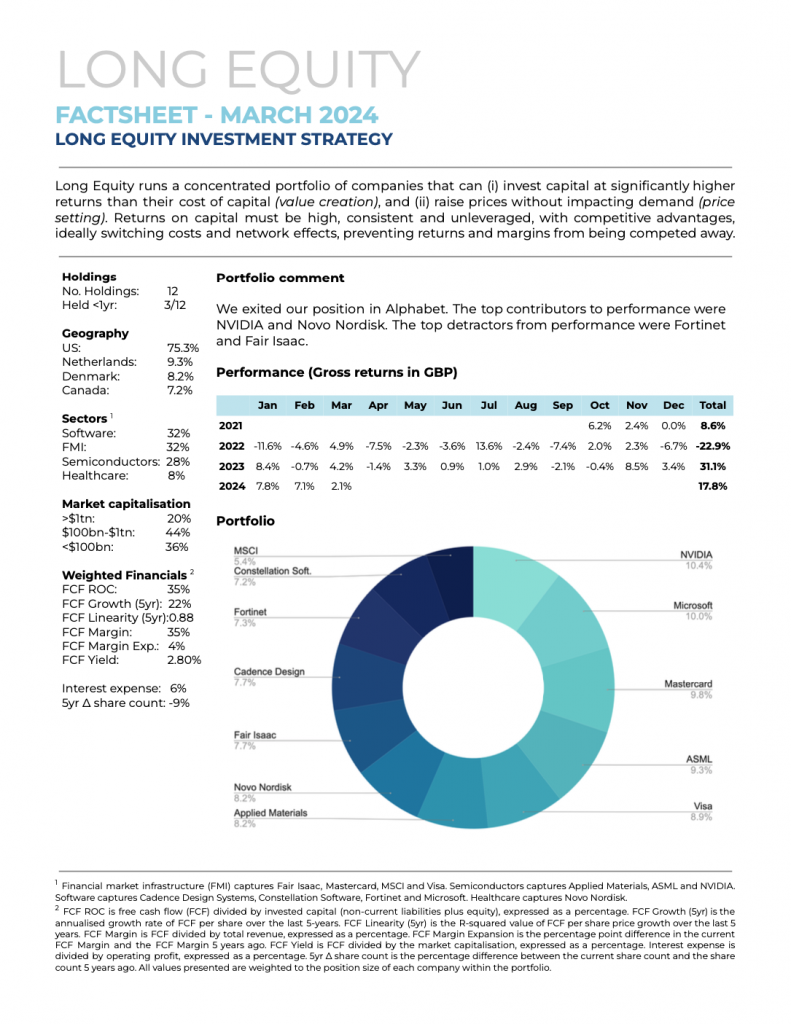

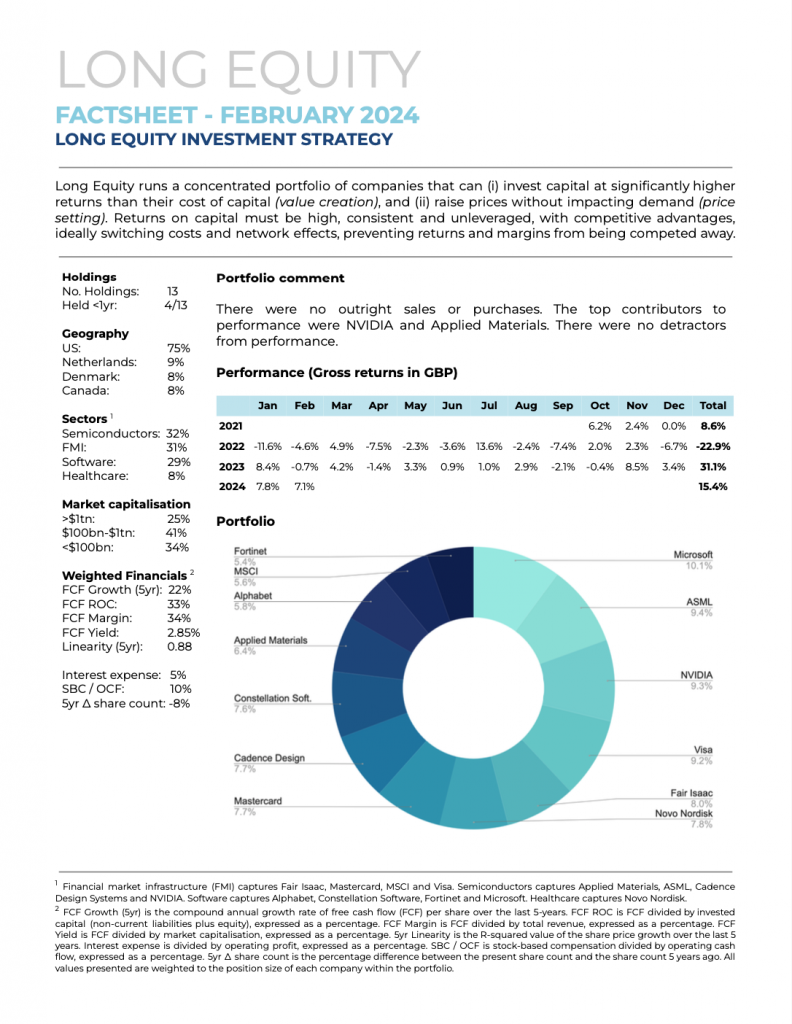

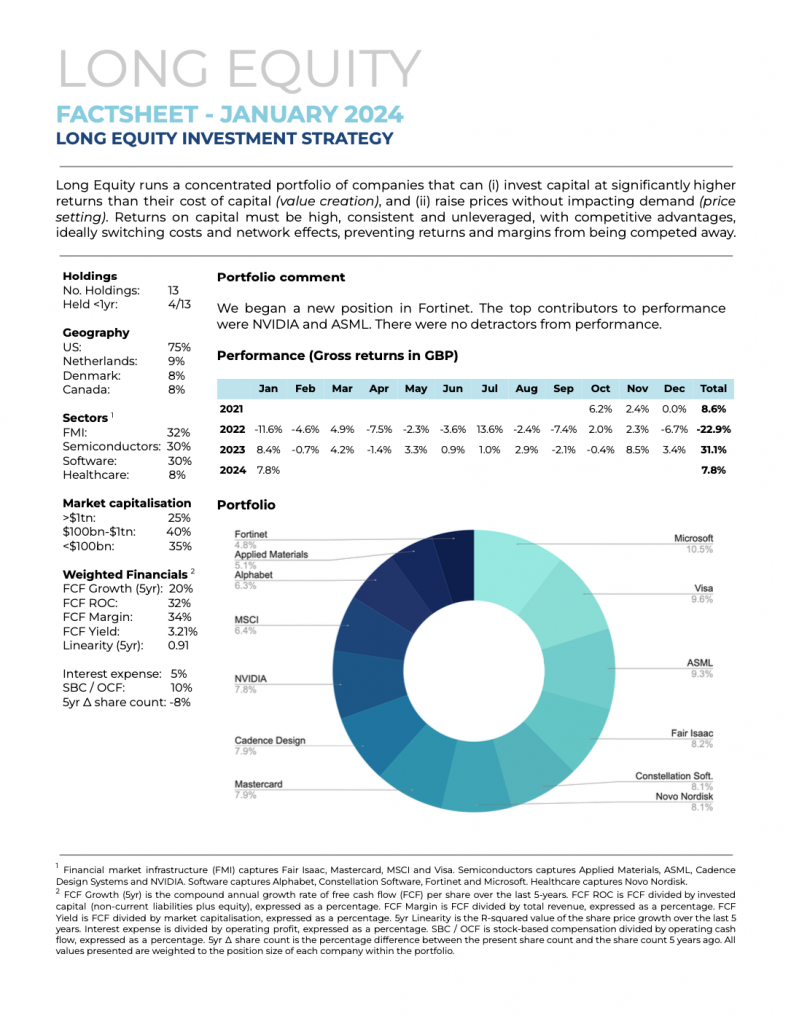

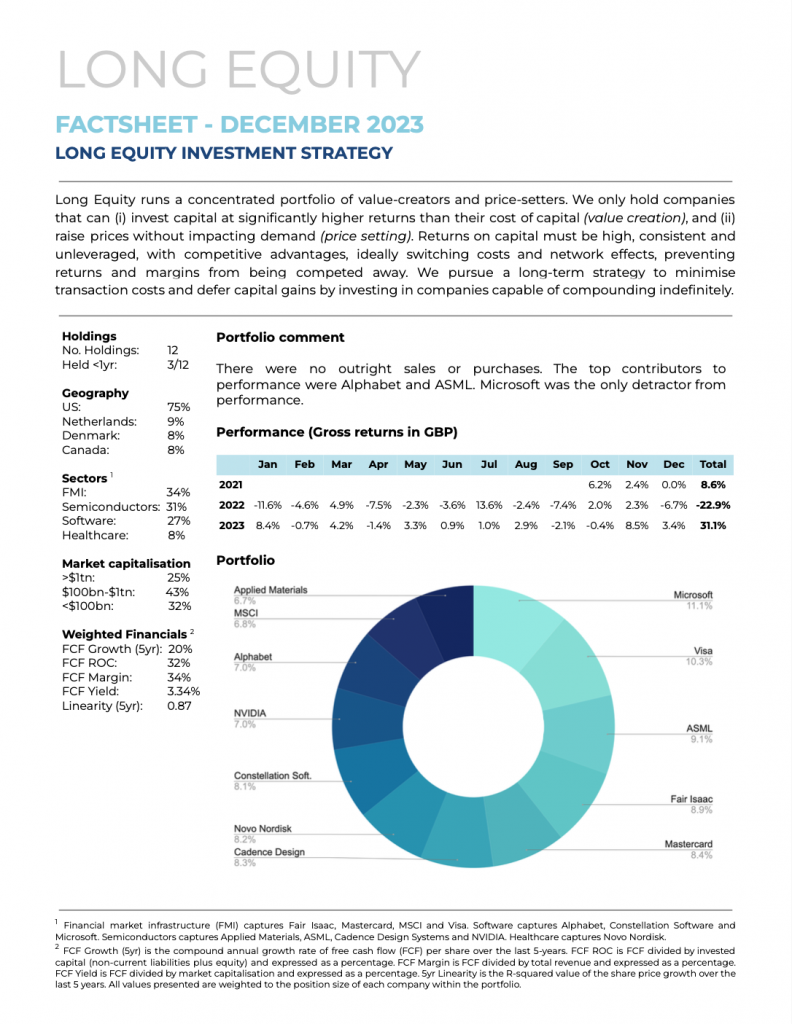

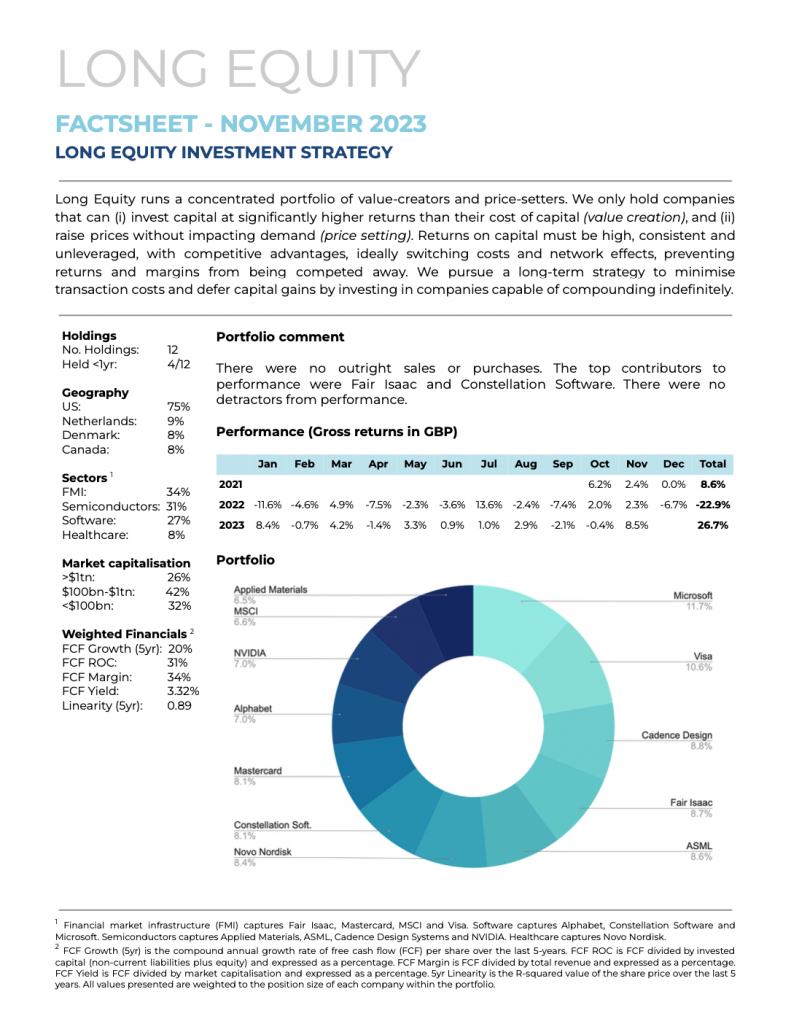

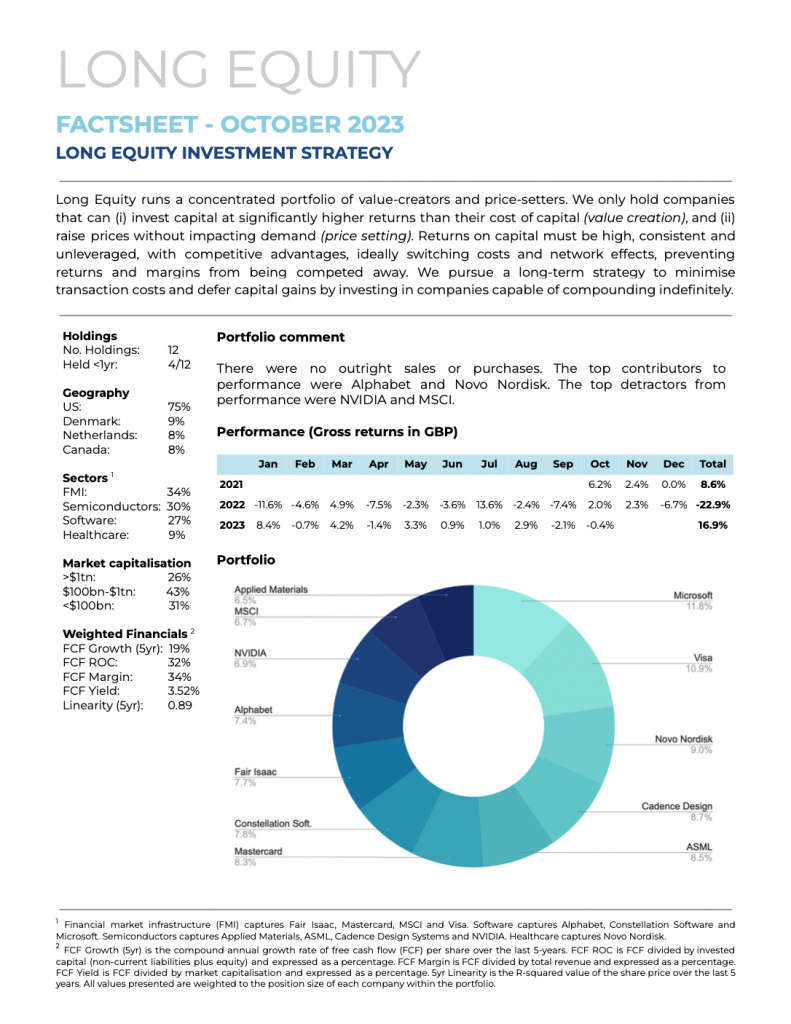

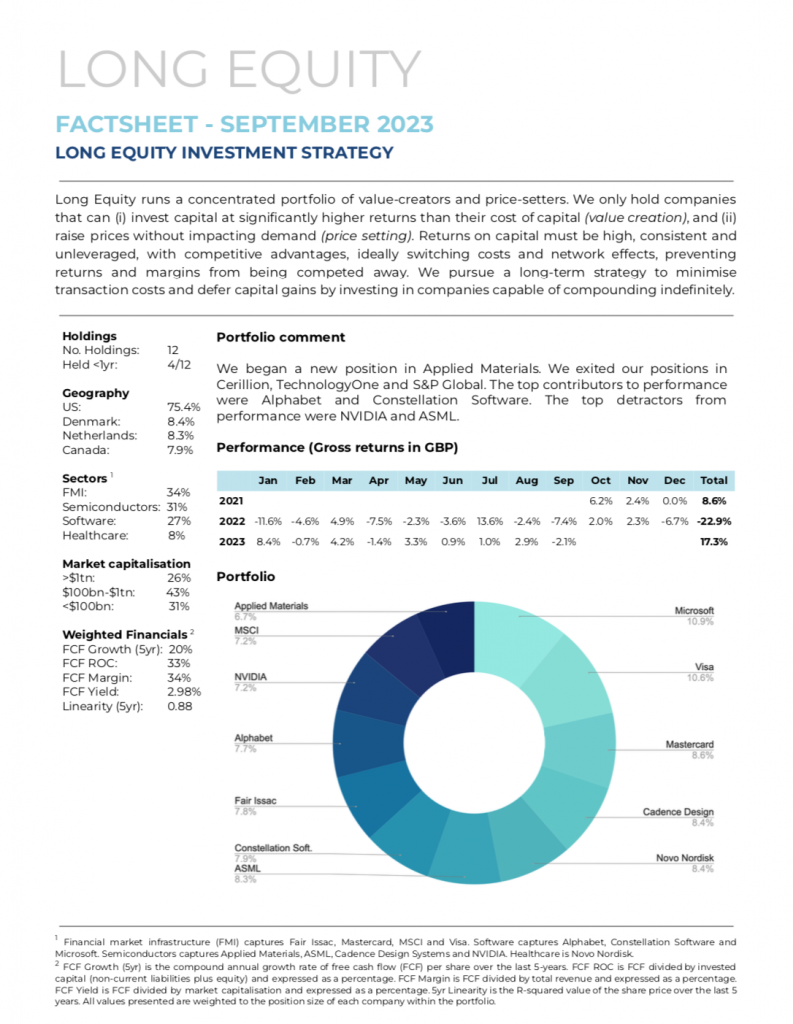

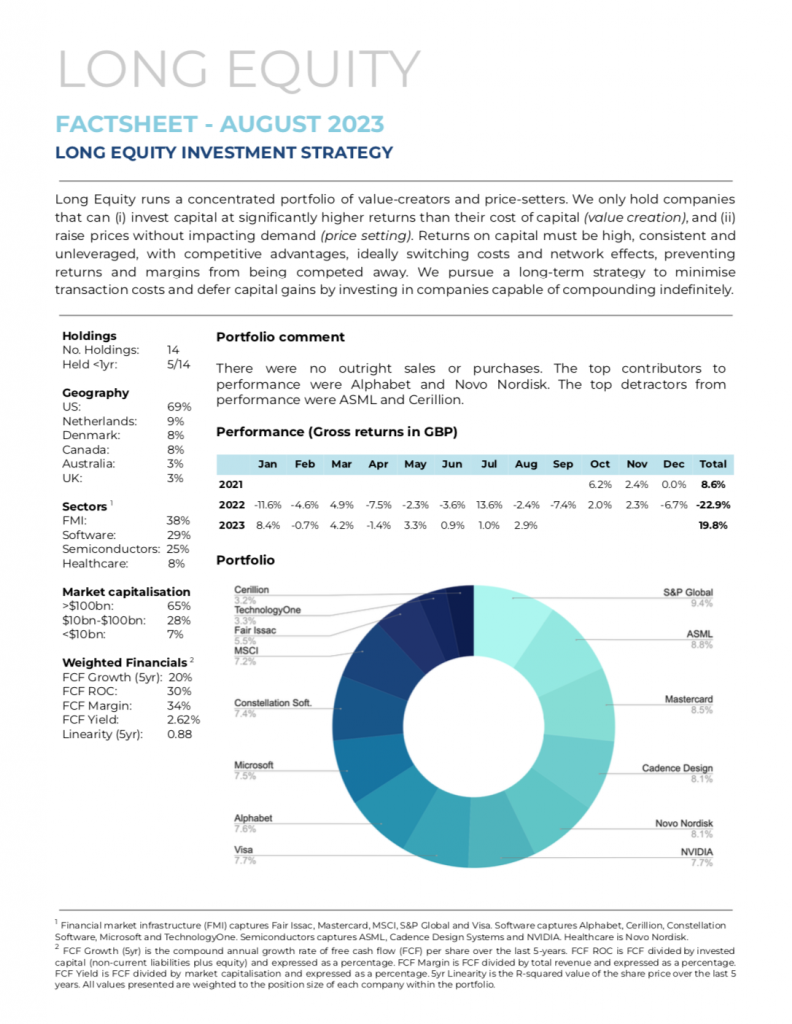

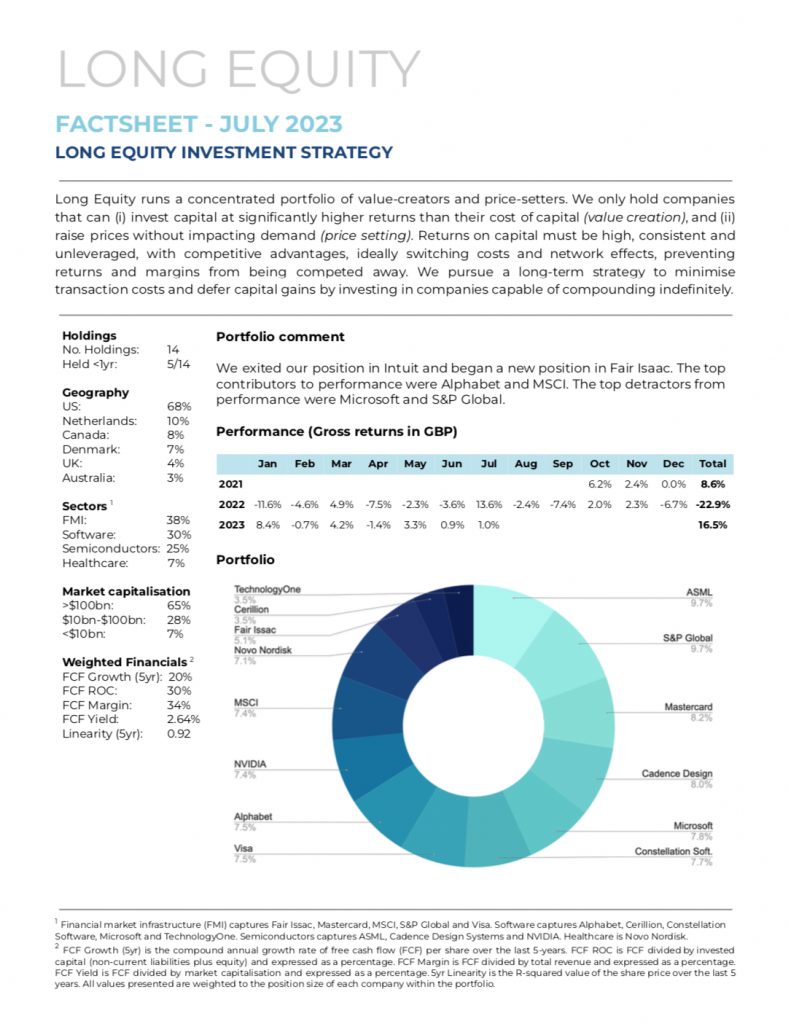

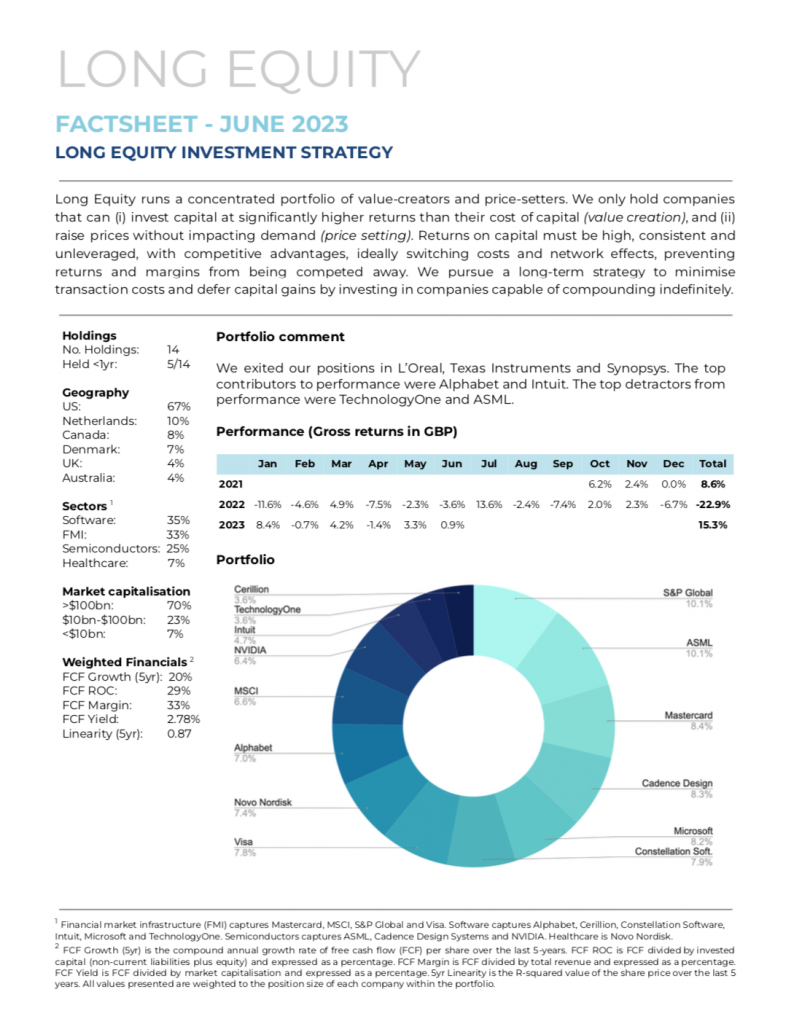

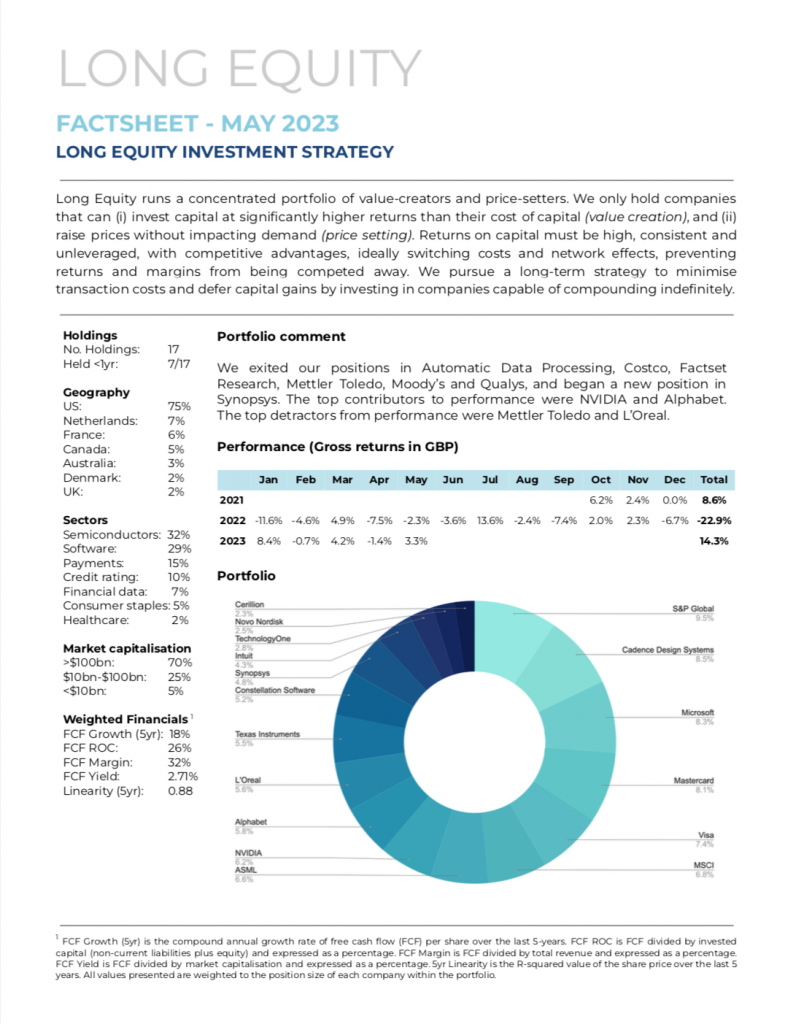

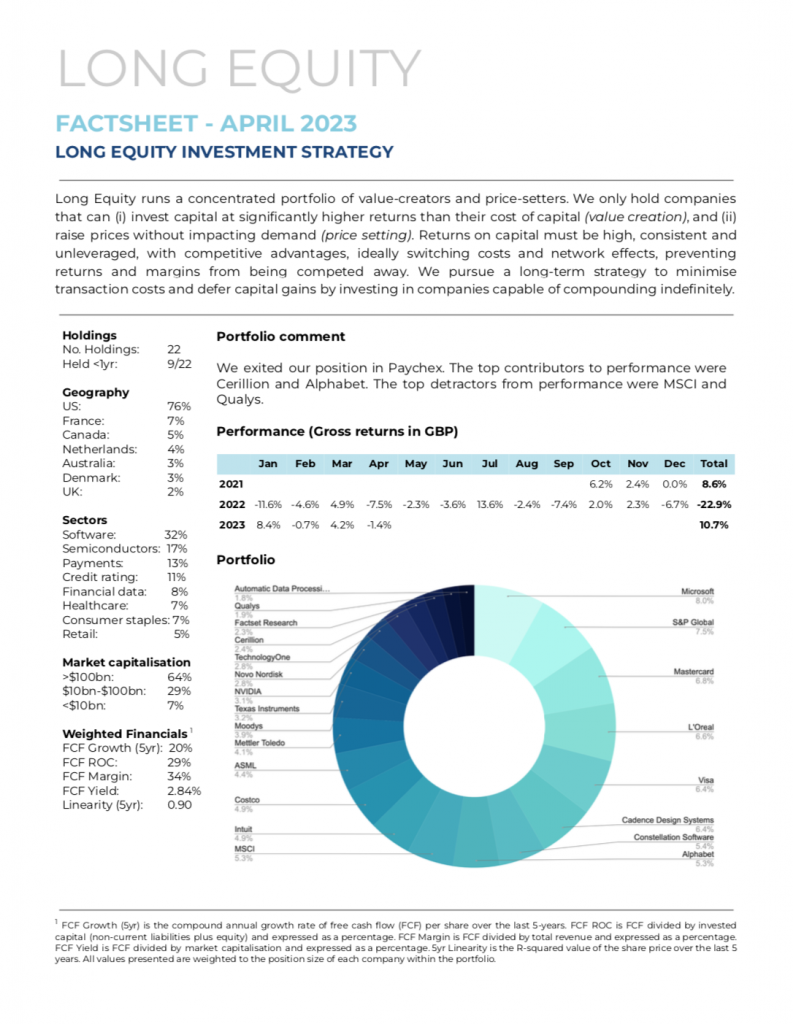

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 6.2% | 2.4% | 0.0% | 8.6% | |||||||||

| 2022 | -11.6% | -4.6% | 4.9% | -7.5% | -2.3% | -3.6% | 13.6% | -2.4% | -7.4% | 2.0% | 2.3% | -6.7% | -22.9% |

| 2023 | 8.4% | -0.7% | 4.2% | -1.4% | 3.3% | 0.9% | 1.0% | 2.9% | -2.1% | -0.4% | 8.5% | 3.4% | 31.1% |

| 2024 | 7.8% | 7.1% | 2.1% | 17.8% |

Q&A

We are open to investing in all market, all sectors and at all capitalisations.

However, our requirement for companies to be superior value creators (evidenced by high returns on capital and free cash flow growth) and superior price setters (evidenced by high gross margins and competitive advantages) means that very few companies reach our threshold. We endeavour to own the best companies in our investable universe, while also ensuring diversification.

Above all else, our focus is on picking only the highest quality growth companies. We track multiple measures of quality, growth and valuation, which we then use to rank and score each company we own and follow in our investable universe. This allows us to buy what we observe are the best investment opportunities.

We are willing to invest anywhere, not just the US.

While currently the majority of our holdings are in US listed companies this does not mean we’re not globally diversified. Where a company is listed and headquartered does not reflect where it generates its sales.

This means that our portfolio is still globally diversified, despite holding mostly US stocks.

We are willing to invest in any country.

Currently, our exposure to emerging economies is indirect through other holdings, rather than through direct investments in companies listed and headquartered in emerging economies. All our investments are multinationals with exposure to both developed and developing economies. For example, ASML is headquartered in the Netherlands and generates 39% of its revenue from Taiwan. The payment companies (Visa and Mastercard) are US headquarted, but provide services in nearly all countries and in nearly all currencies.

Investing in developing economies can be risky. We prefer for this risk to be taken by investing in well diversified multinational companies, rather than by directly investing in countries where property rights and the rule of law may be less established.

We’re open to investing in any sector, not only tech.

All of the companies we invest in use technology.

It’s important to consider the underlying industries that a company is exposed to, as it is the underlying industries that ultimately drives its business.

Our investment style is Quality investing mixed with Growth investing.

In the investment world there are three main investment styles: Value, Growth and Quality. MSCI Inc. runs indices for each of these styles. Quality investing significantly outperforms the benchmark, while Value investing significantly underperforms. The rank of each investment style’s performance is typically as follows: Quality > Growth > Value.

The Long Equity investment strategy is a combination of the best parts of each of these three styles. Practically this means we favour companies with high ROC, low debt and predictable sources of earnings growth. While we consider valuations, we prioritise our analysis of the underlying business.

To ensure diversification we invest across a variety of sectors and industries (e.g. payment services, credit rating & scores, semiconductors, software and healthcare). Other sectors are too cyclical and capital intensive.

The companies we invest in mostly have exposure to both developed and emerging markets, and therefore the fund is globally diversified despite only holding developed market stocks.

We aim to invest in 10-20 companies. The main practical reason for targeting a low number is that there are very few ultra high-quality companies to select from. Additionally, holding 10-20 investments obtains all the benefits of both diversification and concentration. The benefits of diversification are that it reduces the risk of being overly exposed to a single company, sector or geography. The benefits of concentration are that the portfolio is less likely to look like the benchmark, therefore less likely to track the performance of the benchmark and less likely to deliver an average performance.

We avoid individual positions taking up less than 2% of the portfolio, allowing each investment to make a meaningful impact on performance.

Any share price growth over any time period can be understood by the growth in earnings and the change in valuation (the price multiple). Therefore we seek to understand what has driven share price growth and whether the balance leans more towards earnings growth (good) or towards an increased valuation (less good).

The most frequently used metric by investors for valuation is the price-to-earnings ratio. Most investors focus only on the price part of the ratio when valuing a company and neglect to consider the quality of the earnings they are valuing. We only value earnings that represent a high return on capital, have a predictable source of growth, demonstrate low cyclicality, arrive in cash and do not require high leverage to generate. We then compare the market valuation of the company’s earnings with the earnings of other equally high-quality companies. This allows us to pinpoint which of the companies we own and follow are trading at comparatively attractive valuations.

We also compare the company’s FCF yield to both the S&P 500 earnings yield and the 10-year Treasury bond yield (a proxy for the risk-free rate). High quality companies typically come with high valuations, which are often reflected in the companies we own and follow having FCF yields less than the S&P 500 earnings yield.

In the possible event that we do overpay, our long-term buy-and-hold approach means that eventually the performance of an investment’s high-quality underlying business should bail us out.

Not at all. Integral to compounding is retaining earnings to reinvest. Dividends and share buybacks are a leak in the compounding cycle. If a company can invest its capital at high returns and has predictable sources of growth, then dividends make little sense.

Any dividends paid out by our portfolio companies are reinvested into the portfolio.

Long Equity is currently private and closed to new investment. We hope to formally launch in the near future, initially through operating Separately Managed Accounts (SMA), before possibly utilising the partnership model.