The world’s most investable companies:

Long Equity runs a quality growth portfolio of companies with high returns on capital and high free cash flow per share growth.

The portfolio primarily invests in firms listed in the MSCI World Quality index and assigned a Morningstar wide-moat rating.

"I enjoyed the book and I recommend it. It’s all well worth it." - Chris Mayer (author of 100 Baggers)The Long Equity Investment Strategy

Long Equity runs a single, concentrated, quality growth investment strategy consisting of value-creating and price-setting global companies. We only hold companies that can: (i) invest their capital at significantly higher returns than their cost of capital (value creation); and (ii) raise their prices without impacting demand (price setting).

Our aim is to research and analyse what works and what doesn’t work in investing, and then to continuously refine an investment strategy built on doing what works and completely avoiding what doesn’t.

1. Quality

We only invest in companies that can maintain consistently high returns on capital. To ensure that high returns can be maintained into the future, we look for companies that are highly resilient to interest rates, inflation, competition and geopolitics.

We favour companies selling essential services to a large number of other businesses, and avoid companies selling discretionary products to consumers.

2. Growth

We look for companies that in addition to high returns on capital, are also growing their free cash flow per share – ideally through a combination of growing sales, flexing their pricing power, operational leverage and share buy-backs.

Growth should be non-volatile over the long-term, diversified (globally and across business lines), insulated from economic cycles and not require high leverage to generate.

3. Value

We maintain a database of the 20-30 companies that meet our exceedingly high threshold for quality and growth. This ensures we only value the highest quality cash flows.

We then value each company by comparing what we forecast their future free cash flow per share will be in 3-5 years time with the current share price – this calculates the forward FCF yield.

4. Concentration

We maintain a concentrated portfolio (12-20 companies) based on where we see the best long-term investment opportunities. To avoid being overly concentrated or diversified, we endeavour to keep sizes between 4-16% of the portfolio.

We pursue a long-term strategy that aims to minimise transaction costs and defer capital gains by only investing in companies capable of compounding value indefinitely.

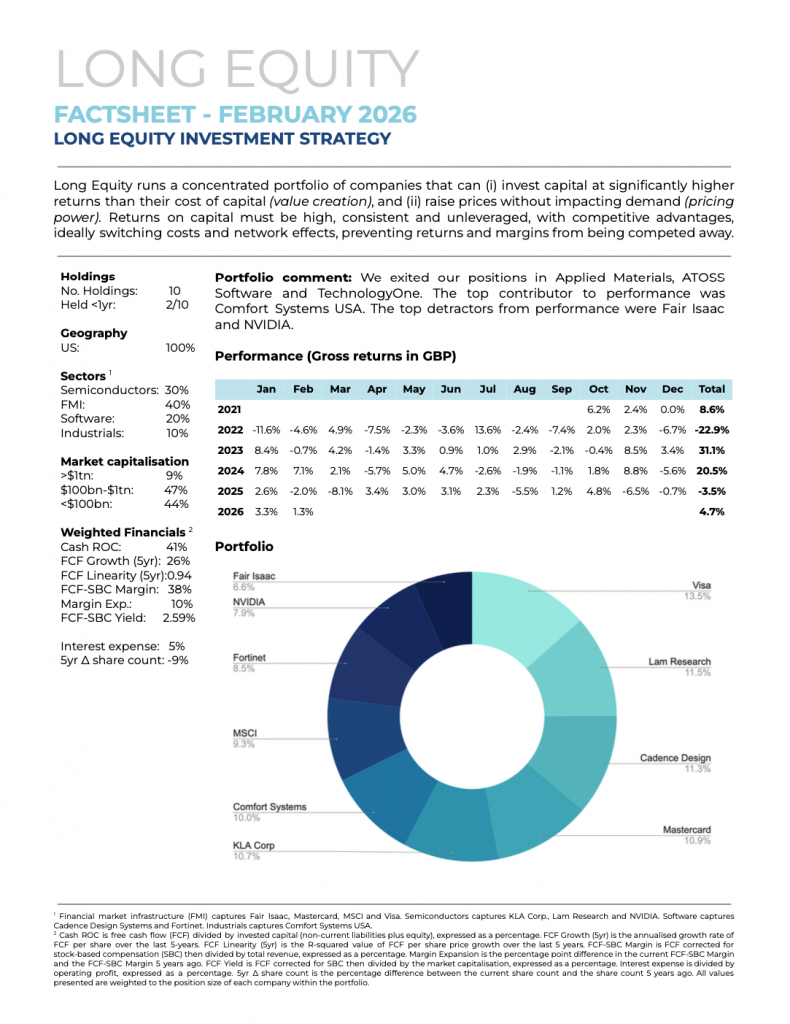

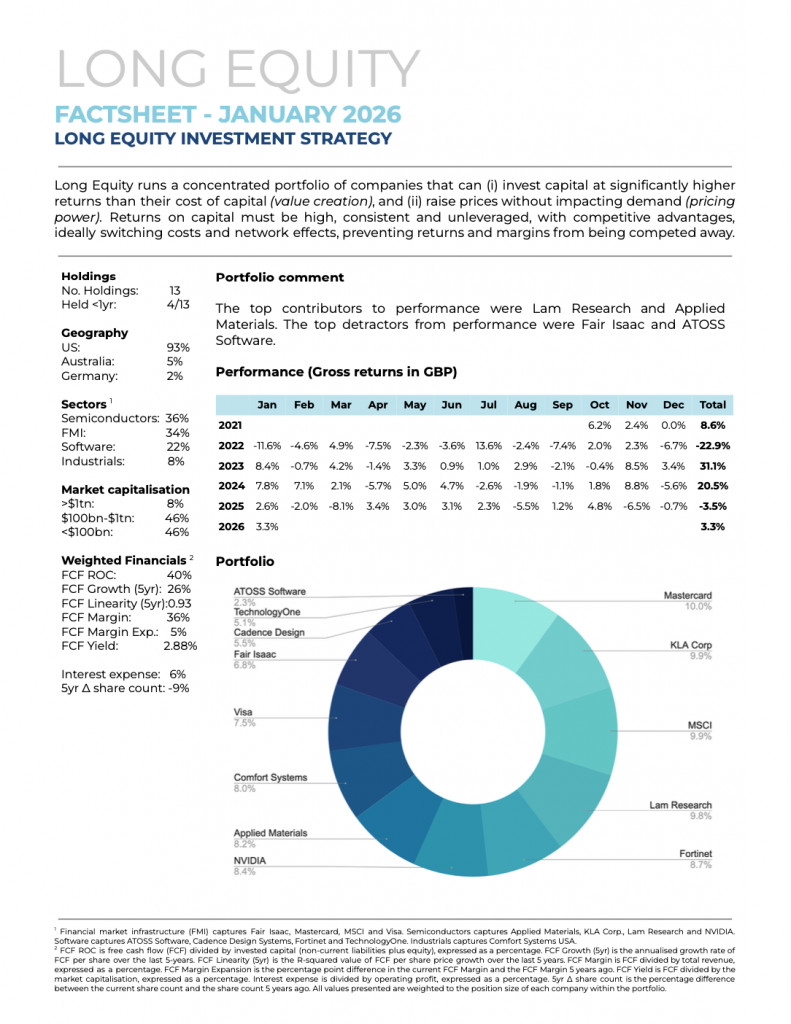

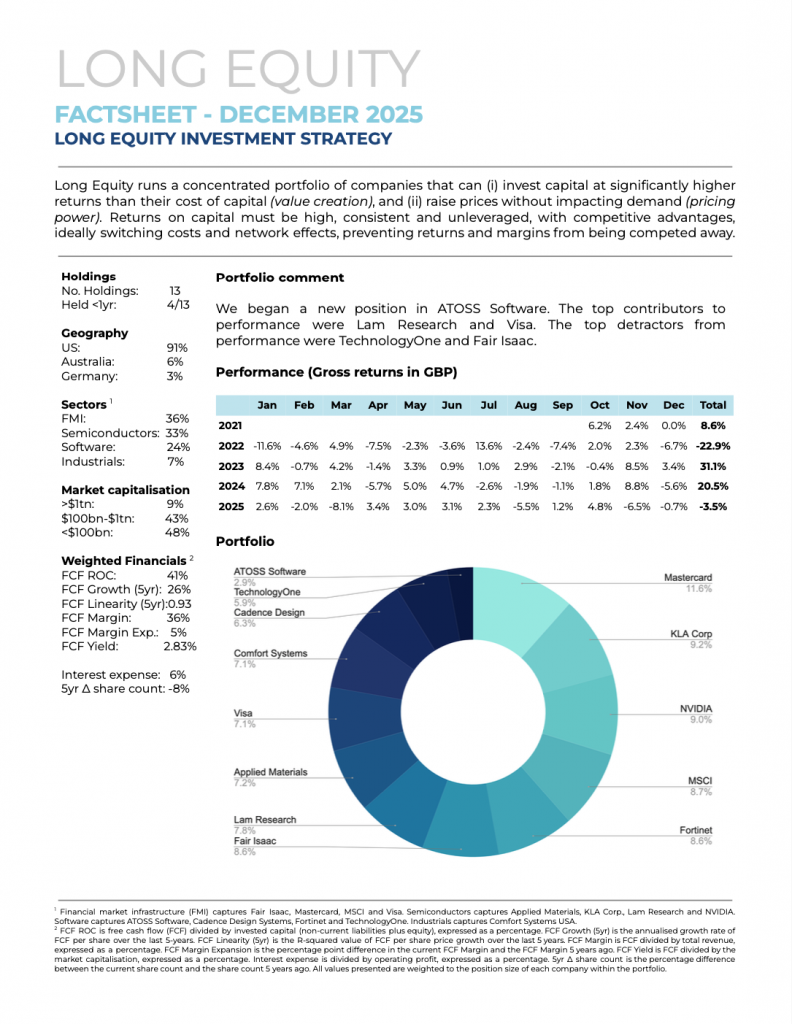

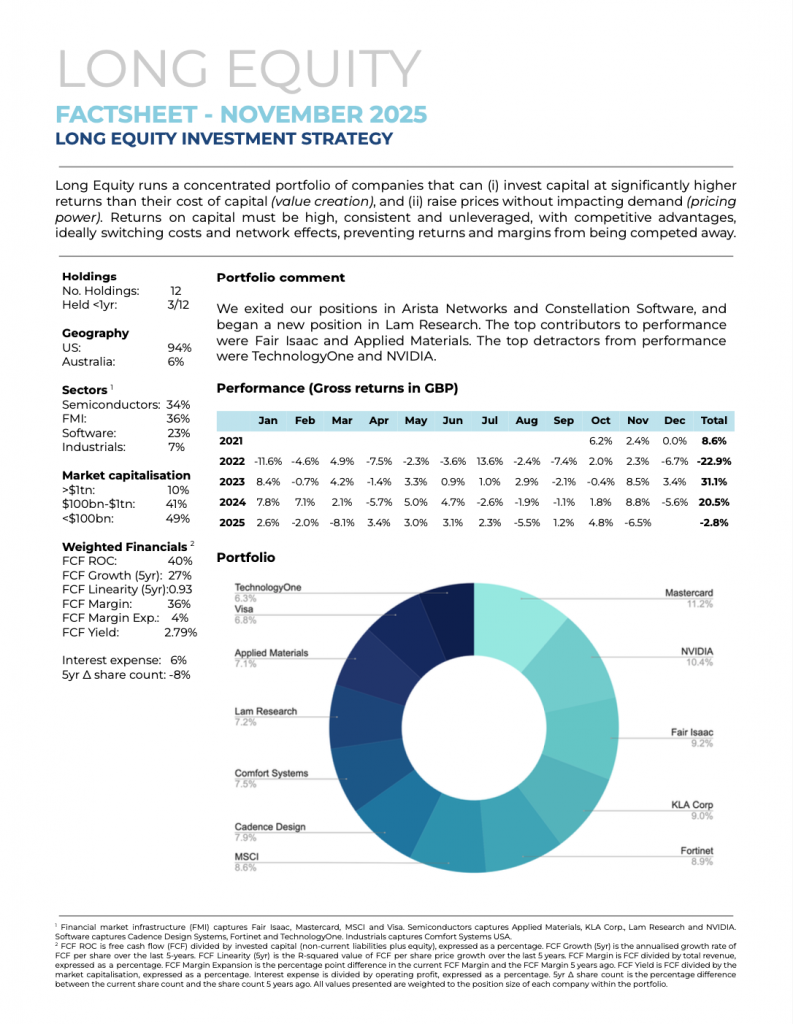

Performance (Gross returns in GBP) – last updated 27 February 2026

| YTD | 2025 | 2024 | 2023 | 2022 | Inception (1 Oct 2021) | Annualised | |

|---|---|---|---|---|---|---|---|

| Long Equity | 4.7% | -3.5% | 20.5% | 31.1% | -22.9% | 33.8% | 6.8% |

Factsheets

Presentations

– Pitchbook available on request –

Not all growth is quality growth.

- A company may be growing its revenue, but not its free cash flow (i.e. top line growth, but no bottom line growth).

- A company may be growing its free cash flow, but have low returns on capital (i.e. growth is dependent on increasing amounts of debt).

- A company may be growing its free cash flow by investing at high returns on capital, but lack the resilience to competition and economic cycles to ensure that growth can continue into the future (i.e. highly cyclical and no competitive advantages).

- A company may be highly resilient, but be operating in a declining market, meaning there’s uncertainty as to whether growth will continue (i.e. weak market economics).

A quality growth company grows both its revenue and its free cash flow, it does so by reinvesting profits at high returns on capital and has the pricing power, resilience and the market to continue growing for years to come. Such companies represent only a tiny segment of the equity market. This is where the Long Equity investment strategy invests.

Most quality funds and quality indices seek to hold the best companies from a wide range of sectors, including consumer staples, consumer discretionary, energy, materials and utilities. However, many sectors don’t have the high returns on capital, high FCF per share growth and specific types of competitive advantages (e.g. network effects, switching costs) that we’re looking for.

Our strategy seeks to avoid companies that sell directly to consumers and/or sell discretionary products. Instead we prefer to look for highly predictable and resilient free cash flow growth from companies that sell essential services directly to businesses. For that reason our portfolio is concentrated into payment systems, semiconductors, specialist software-as-a-service (e.g. cybersecurity), data providers and healthcare.

Short-term market volatility is inherent to equities. We think risk is best controlled through the selection of high quality stocks, not financial engineering (i.e. hedging/shorting). We select companies that aren’t susceptible to competitive threats, macroeconomic events and political and regulatory risk. We avoid companies with weak and highly-leveraged balance sheets. We avoid speculative investments, such as companies lacking a track record or going through a restructuring. We avoid speculative asset classes, such as currencies, commodities and derivatives. We also maintain a liquid portfolio, so that we can quickly sell out of a position if a company’s circumstances change or if there is high market volatility.

To ensure diversification we invest across a variety of sectors and industries (e.g. payment services, credit rating & scores, semiconductors, software and healthcare). Other sectors are too cyclical and capital intensive. The companies we invest in mostly have exposure to both developed and emerging markets, and therefore the fund is globally diversified despite only holding developed market stocks. We avoid individual positions taking up less than 2% of the portfolio, allowing each investment to make a meaningful impact on performance.

We only value earnings that represent a high return on capital, have a predictable source of growth, demonstrate low cyclicality, arrive in cash and do not require high leverage to generate.

We compare what we forecast the company’s future free cash flow per share will be with its current share price (the forward FCF yield). We then compare the valuation with those of other equally high-quality companies, to ensure we pinpoint the best opportunities.

Long Equity is currently private and closed to new investment. We hope to formally launch in the near future, initially through operating Separately Managed Accounts (SMA), before possibly utilising the partnership model.

© Long Equity 2026. All rights reserved.